We founded RetireSURE Wealth Management in the midst of the 2008 financial crisis. From our perspective, this event exposed the weaknesses of conventional approaches to wealth management.

We made it our mission to implement a process that would better serve our clients over the long term.

Especially when you’re approaching retirement, your own timeline may not line up with that of your buy-and-hold strategy, so we built a more process-driven and client-centric wealth management platform. This platform is based on relative strength methodology and informed by a comprehensive wealth plan designed around your life.

Our mission has been to root out all emotion, predictions and subjective opinion from the wealth management process and replace them with strategy, process and discipline. We want to help you get the clarity you need to be comfortable with your long-term financial stability.

It’s possible to find some measure of success with short-term forecasts and lucky picks -- but generating consistent results over long periods of time can be extremely challenging. Since all of our clients’ most essential priorities are in the long term, that’s where we strive to provide value and that’s how we build lasting client relationships.

As fiduciaries we are held to a regulatory framework that prevents any potential conflicts of interest, and as professionals we advise our clients as we would for our own families. We believe the advisor-client relationship is predicated on complete transparency and alignment of interests.

With buy and hold, if you’re holding the wrong investments you can introduce serious risk into your portfolio and your plans for retirement. Relative strength is about keeping a mix of the strongest investments at any given time through an active approach to asset allocation.

Investment markets, like all other markets, are driven by the basic principle of supply and demand. Buyers drive prices up and sellers drive prices down. Aligning your portfolio with these trends is key to capturing the growth you need for the long term, while mitigating unnecessary risk along the way.

We believe that preserving capital is the kind of priority that takes precedence over all others. Our goal is to participate in up markets, but our rules-based investment platform enables us to take action when we detect significant risk.

Our mission has been to root out all emotion, predictions and subjective opinion from the wealth management process and replace them with strategy, process and discipline. We want to help you get the clarity you need to be certain of your long-term financial stability.

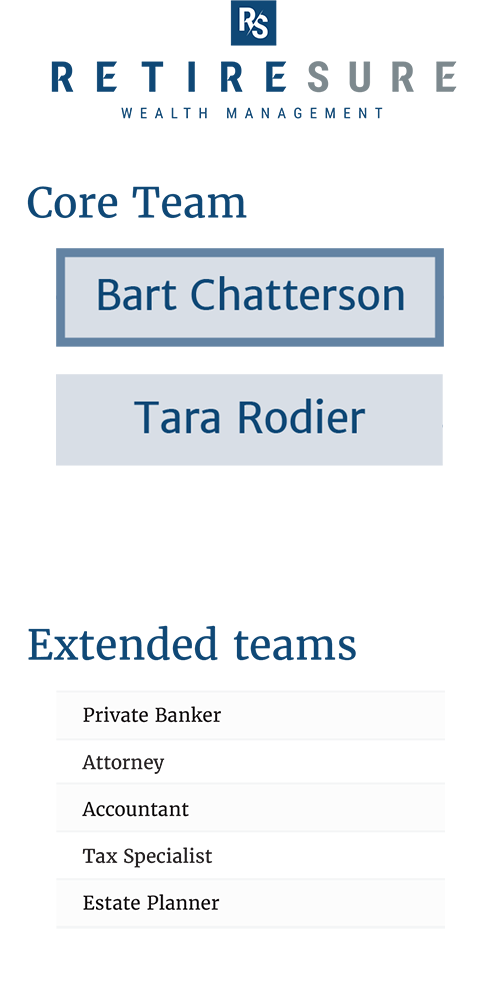

Since 1998, Bart Chatterson has been providing investment and retirement advice to clients and their families. He spent 10 years with two of Canada’s largest full-service investment firms before starting his own practice with HollisWealth in 2008.

READ FULL BIOAfter several years of client services experience, Tara Rodier joined RetireSURE Wealth Management in 2017 as an Administrative Assistant and has since worked her way up to Associate Investment Advisor.

READ FULL BIOChad's exceptional blend of experience as a professional athlete, accomplished entrepreneur, and financial professional positions him as a valuable asset in his new role at IA Private Wealth.

READ FULL BIO

Since 1998, Bart Chatterson has been providing investment and retirement advice to clients and their families.

He spent 10 years with two of Canada’s largest full-service investment firms before starting his own practice with HollisWealth (now iA Private Wealth) in 2008. His experience through the financial crisis became pivotal in the development of his rules-based investment process and disciplined approach to wealth management.

Bart holds a Bachelor of Commerce in Finance and Marketing from the University of Saskatchewan, as well as the Professional Financial Planner designation and licenses in estate planning and insurance. In 2018, he also attained the Portfolio Manager designation, held by less than 5% of advisors in Canada, which enables him to provide his clients with a more efficient and tailored experience.

Bart was raised on a farm in Southeast Saskatchewan and spent several years in manufacturing and retail management before entering the financial services industry. Altogether, his ongoing education and professional background have enabled him to build a full-service wealth management platform that has had particular value for pre-retirees, business owners and farmers. Today, Bart lives in Saskatoon with his wife and two children. He enjoys supporting his children and his community, and was named Coach of the Year in 2007 for his involvement in children’s hockey programs.

After several years of client services experience, Tara Rodier joined RetireSURE Wealth Management in 2017 as an Administrative Assistant and has since worked her way up to Associate Investment Advisor.

After finishing various finance and administration classes at Saskatchewan Polytechnic, Tara completed the requirements for both the securities and insurance industry, earning her a Securities and Life Insurance License.

As an Associate Investment Advisor, Tara is your first point of contact for your account and administration needs. She is responsible for all aspects of client services and the day-to-day administration of accounts. With a strong attention to detail, Tara prides herself on delivering prompt and efficient service.

Outside of the office, Tara enjoys travelling, hiking in the mountains, and spending time with her busy family.

Chad Rempel joins RetireSURE Wealth Management, iA Private Wealth after a remarkable 17-year career as a professional football player in the Canadian Football League (CFL) from 2005 to 2021. Playing as a wide receiver and long snapper, he achieved numerous accolades, including being a team captain, winning Grey Cup Championships with the Toronto Argonauts in 2012 and the Winnipeg Blue Bombers in 2019, and being the first long snapper to receive CFLPA All-Star recognition.

Alongside his football career, Chad possesses a strong entrepreneurial background. At the age of 20, while studying at the University of Saskatchewan, he opened the first Booster Juice franchise in Saskatchewan. Within three years, Chad transformed it into the highest-grossing store out of 200+ locations, showcasing his exceptional management skills and ability to foster a thriving team culture.

Expanding his skill set, Chad ventured into the financial services industry as a client partner at Clear Street-Centerpoint Securities. In this role, he provided comprehensive coverage, direct market access, and risk management to high-net-worth retail traders, leveraging his unique skill set and experience.

Chad's exceptional blend of experience as a professional athlete, accomplished entrepreneur, and financial professional positions him as a valuable asset in his new role at IA Private Wealth. His unwavering dedication, exemplary leadership, and ability to thrive in demanding environments position him for continued success in the financial services industry.

Beyond his professional pursuits, Chad is a devoted father to two young boys, finding joy in spending quality time with his family and coaching youth sports.

Ryan began his career in retail banking in 2011 and in 2017 earned the Certified Financial Planner (CFP®) designation through the Financial Planning Standards Council.

Ryan joined RetireSURE Wealth Management in 2021. As a Marketing Assistant, he focuses on innovating marketing campaigns and connecting with our clients to provide updated information on RetireSURE's financial service offerings, operations, and updates. Because education is extremely important to Ryan and he considers himself a lifelong learner, he is currently studying to become licensed as an Investment Associate with RetireSURE.

Born and raised in Saskatoon, Ryan is a husband and father of two young children and enjoys reading, camping, and various outdoor activities with friends and family.