Your investment portfolio is only as strong as your protection strategy. Generating long-term growth also means having safeguards against the risks that can be detrimental to your financial stability, and having processes in place to adapt to the smaller fluctuations that happen as life goes on.

Our approach to rules-based, systematic investing is customized to the needs of each client and rooted in relative strength methodology, which has three central components:

We initiate an analysis and ranking system that is designed to identify what is strongest in the market at the present moment. This system is based on supply and demand as well as price flows. Beginning with asset classes, we move on to sectors and individual securities in order to build a portfolio of investments with high relative strength.

Our active management approach is supported by advanced software that we populate with your investments and your custom buy/sell criteria. This enables us to identify precisely when individual holdings are losing their relative strength, so that we can move into ones that are on the way up. This is a continuous process that helps you maintain a healthy mix of investments at all times.

While our day-to-day management process helps manage normal market volatility, this risk control mechanism is designed to mitigate the effects of large-scale market downturns. By identifying declining relative strength in the equities overall, we’re able to move the portfolio out of this asset class completely. The equity action call is a vital failsafe against events like the ’08 crisis, which it identified a few months prior.

Once you know that you’ll be alright in the long run, you can start focusing on the here and now. That’s why we start by understanding big-picture priorities like retiring on time, building lasting wealth and leaving an estate for your children.

Within this framework we begin adding details to that picture as we establish mid-term and short-term goals - that’s how you get a Solid Understanding of your Retirement Essentials, and that’s how we identify the strategies that will make up your comprehensive plan.

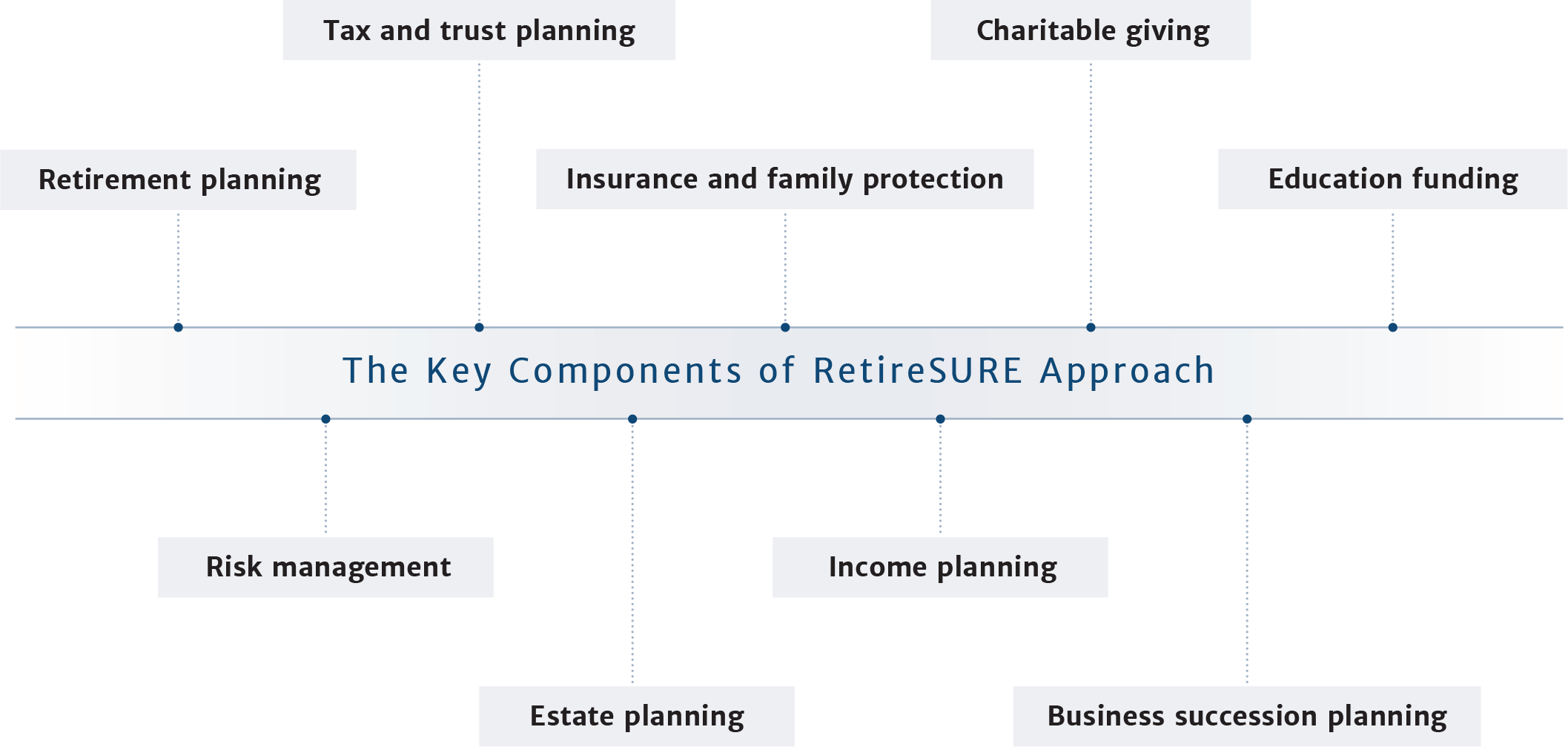

Working in tandem with your InvestSURE portfolio, the RetireSURE Approach incorporates all key components of your financial picture, including:

The SURE principle underscores each step in our client process. It speaks to the clarity and comfort that happens when you take a systematic approach to planning and managing your wealth.

We provide a client experience that incorporates a network of professional partners, an internal team and a structured process for keeping you on track as life unfolds.

Life can be unpredictable, but that’s okay. Real risk comes from speculating about what’s around the corner and moving ahead without a plan. Our role is to implement a system for navigating decisions and relying on what’s tried and true to guide you to your goals.